When importing goods from Vietnam, ensuring the correct origin certificates and compliance documents is essential for minimizing tariffs and adhering to proper customs procedures. These documents can help businesses avoid unnecessary costs and delays in the customs process, as well as take advantage of any available tariff exemptions.

The primary compliance document to focus on is the Certificate of Origin (CO), which is crucial for obtaining tariff exemptions and meeting the necessary customs requirements. However, there are other important documents to consider as well, including tax rebate certificates for certain types of exports.

This article explores the steps to get the Certificate of Origin in Vietnam, the specifics of the Certificate of Origin Form B, tax rebates for Vietnamese exporters, and how to manage these processes effectively.

How to Get Certificate of Origin in Vietnam?

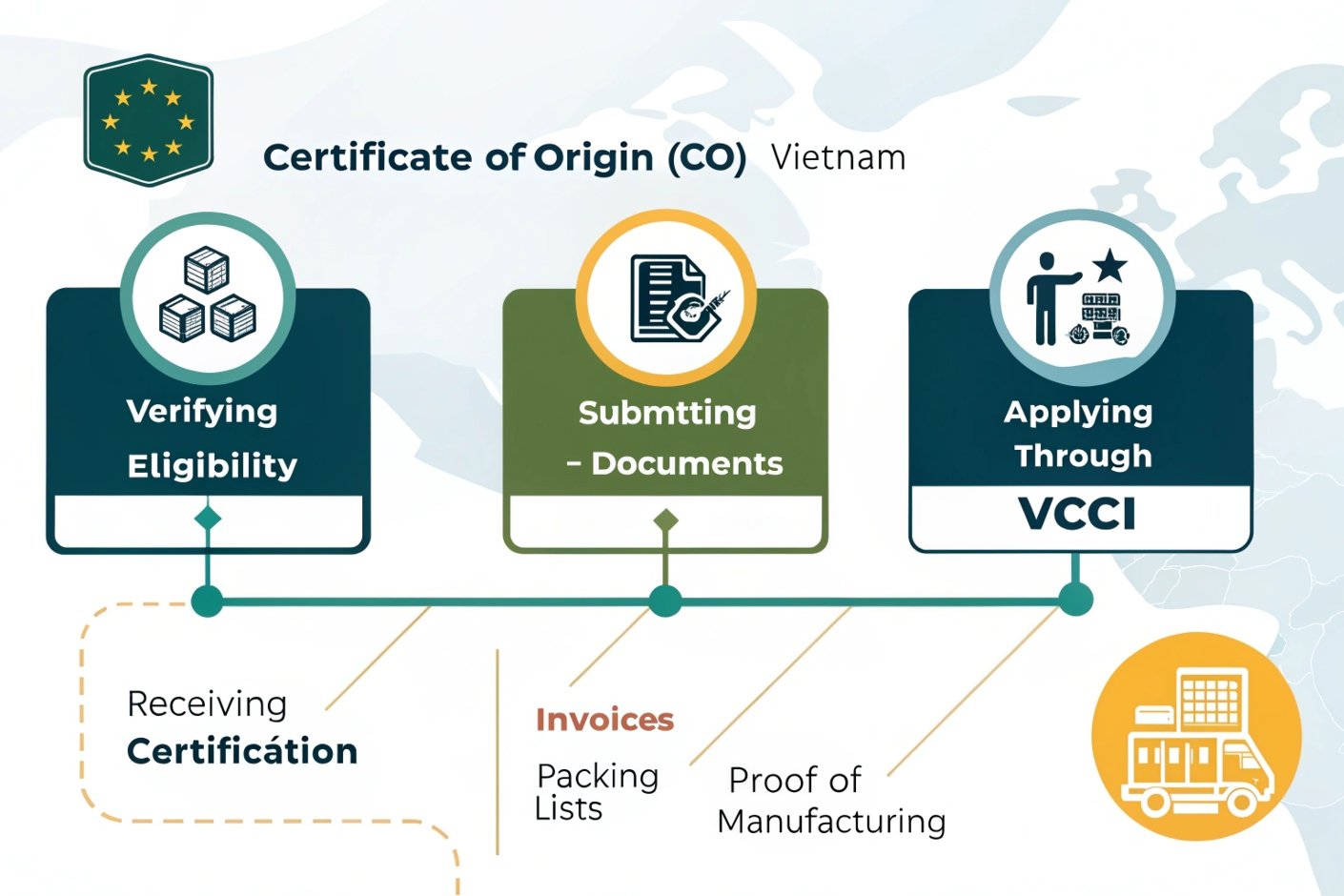

A Certificate of Origin (CO) is required to confirm the origin of goods, particularly for preferential tariff treatment under various trade agreements. In Vietnam, the CO is typically issued by the Vietnam Chamber of Commerce and Industry (VCCI) or other authorized organizations, depending on the product type.

To get a Certificate of Origin1 in Vietnam, the exporter must apply through the relevant chamber of commerce or trade organization, submitting the necessary documents such as invoices, contracts, and proof of product origin. The CO is essential for goods being exported under Free Trade Agreements (FTAs) or to countries with specific tariff preferences for Vietnamese-made products.

Steps to Obtain the Certificate of Origin:

- Verify Eligibility: Confirm whether your product qualifies for preferential tariff treatment based on its origin.

- Submit Required Documents: Provide the necessary paperwork, including commercial invoices, packing lists, and proof of manufacturing processes.

- Application Process: Submit the application to the Vietnam Chamber of Commerce and Industry (VCCI) or authorized bodies.

- Certification: Once the documents are reviewed, the CO will be issued, confirming the product’s Vietnamese origin.

Documents Needed for CO Application:

| Document | Description |

|---|---|

| Commercial Invoice | Details of the transaction and product description |

| Packing List | Details of packaging and shipment |

| Proof of Manufacturing | Documentation confirming the origin of the product |

The Certificate of Origin will typically be required to facilitate smooth customs clearance and access to preferential tariffs under FTAs, including the CPTPP or the U.S.-Vietnam Trade Agreement.

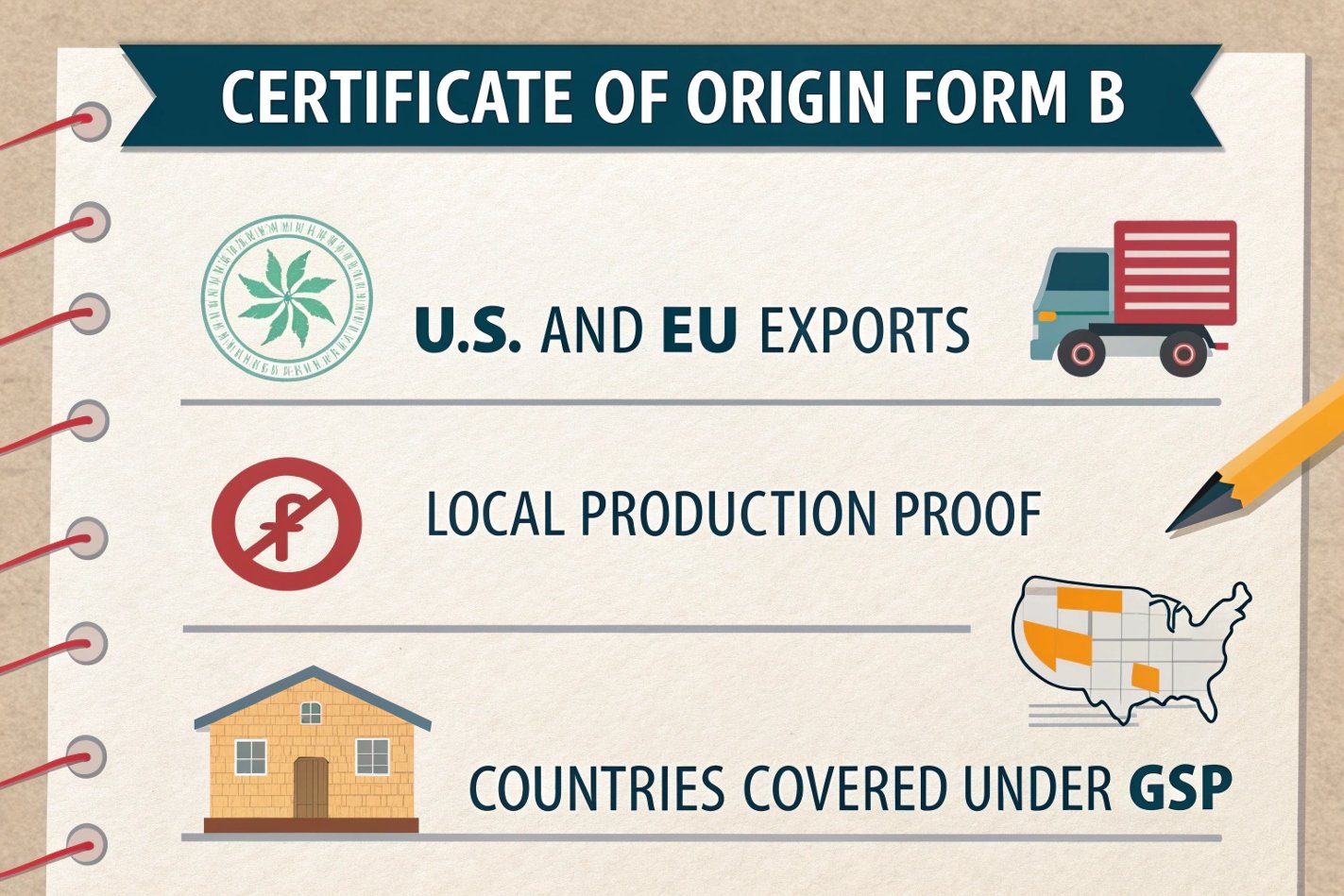

What Is Certificate of Origin Form B in Vietnam?

Form B of the Certificate of Origin2 is specifically used for exports under the Generalized System of Preferences (GSP) or other regional free trade agreements. Form B is typically used for goods exported from Vietnam to countries that are part of the GSP program, such as the European Union or the United States, to receive duty-free or reduced tariff benefits.

Form B is necessary when the goods meet the requirements set forth in the trade agreements, including the rules of origin, which determine the percentage of a product that must be made in the exporting country to qualify for preferential treatment.

Form B is crucial for Vietnamese exporters who want to take advantage of preferential tariff rates when exporting to markets such as the U.S. or the EU. However, it’s essential to verify that the product meets the specific rules of origin under these agreements.

Key Aspects of Form B for U.S. Exports:

| Requirement | Description |

|---|---|

| Origin Criteria | Product must meet the minimum requirement of local content or production |

| Required Documentation | Proof of local production and manufacturing process |

| Countries Covered | Includes U.S., EU, and other countries in GSP |

Ensure that the exporter provides all necessary documents to avoid delays or issues during customs processing.

Do Vietnamese Exporters Receive Tax Rebates Like China When Exporting to the US?

Yes, Vietnamese exporters do receive tax rebates, but the system differs significantly from China’s export tax rebate system. Unlike China, which provides rebates on each export order, Vietnam’s system requires exporters to accumulate a minimum export value3 before qualifying for rebates.

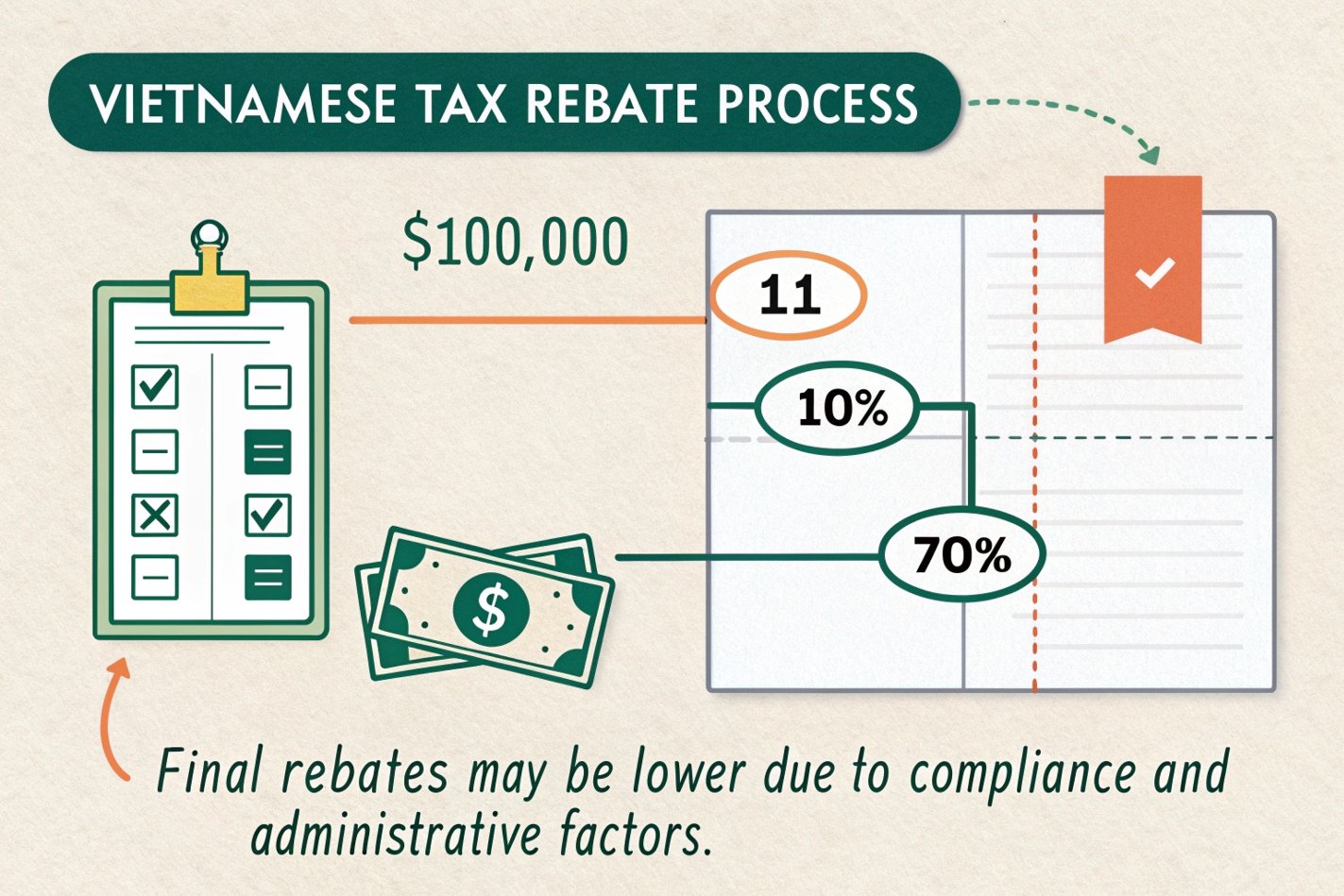

In Vietnam, the tax rebate system4 is not available on a per-order basis but instead requires a minimum export value of approximately $150,000 before a rebate can be processed. Additionally, the rebate rate is typically 10% of the value of the goods, which is calculated by dividing the export invoice value by 1.1 and then multiplying it by 10%.

Rebate Calculation:

If a Vietnamese exporter provides you with an invoice for $100,000, the rebate would be calculated as follows:

- Divide the invoice amount by 1.1: $100,000 / 1.1 = $90,909

- Multiply by 10%: $90,909 * 10% = $9,090

This amount represents the potential tax rebate that the exporter can receive. However, exporters in Vietnam typically only receive around 70% of this rebate due to various restrictions or factors that may impact the rebate process.

Factors Affecting Rebate Amount:

| Factor | Description |

|---|---|

| Minimum Export Value | Rebate is only available after accumulating $150,000 in export value |

| Rebate Calculation | 10% of the invoice value minus taxes |

| Rebate Payout | Exporters typically receive around 70% of the calculated rebate |

Though the rebate system is not as straightforward as in China, it still provides an incentive for exporters and can reduce the overall cost of exporting goods from Vietnam to international markets.

How Much Is the Tax Rebate in Vietnam for Exporting?

The tax rebate in Vietnam typically amounts to 10% of the invoice price, though this is subject to specific conditions such as the product’s origin, its manufacturing process, and the minimum export threshold.

The final rebate received by exporters is typically lower than the calculated amount due to several factors, including compliance checks and various administrative procedures.

Tax Rebate Process:

| Rebate Calculation | Example (Invoice Value: $100,000) |

|---|---|

| Invoice Divided by 1.1 | $100,000 / 1.1 = $90,909 |

| Multiply by 10% | $90,909 * 10% = $9,090 |

| Final Rebate (70%) | $9,090 * 70% = $6,363 |

It’s important for businesses to understand that while these rebates can provide a financial benefit, they are not as easily accessed as those available in other countries like China. Companies looking to export from Vietnam should plan accordingly to ensure they qualify for these rebates and can benefit from them.

Conclusion

When importing from Vietnam, it is critical to secure the correct origin certificates and compliance documents to ensure proper customs clearance and take advantage of any available tariff exemptions or rebates. The Certificate of Origin, particularly Form B, is a crucial document for accessing preferential tariffs under various trade agreements. Additionally, Vietnamese exporters can benefit from a tax rebate system, though the process and eligibility requirements differ significantly from other countries like China. By understanding these procedures, businesses can navigate the complexities of importing from Vietnam more efficiently.

Understanding the significance of a Certificate of Origin can help exporters navigate international trade more effectively. ↩

Exploring Form B details can clarify its role in securing tariff benefits for exports under GSP and FTAs. ↩

Knowing the minimum export value is crucial for exporters to qualify for tax rebates and optimize their export strategies. ↩

Understanding Vietnam's tax rebate system can help exporters maximize their benefits and navigate the complexities of international trade. ↩