Understanding the tariff rates and potential exemptions is crucial for businesses exporting goods from Vietnam to the United States. Tariffs can significantly impact pricing, competitiveness, and overall market strategy.

Tariff rates for Vietnamese exports to the U.S. vary widely depending on the product category. While some goods benefit from low or zero tariffs, others may face higher duties. Additionally, certain exemptions or reductions may apply under specific trade agreements or programs.

This article delves into how U.S. tariffs on Vietnamese exports vary by product, explores available exemptions, and offers strategies for businesses to reduce tariff costs.

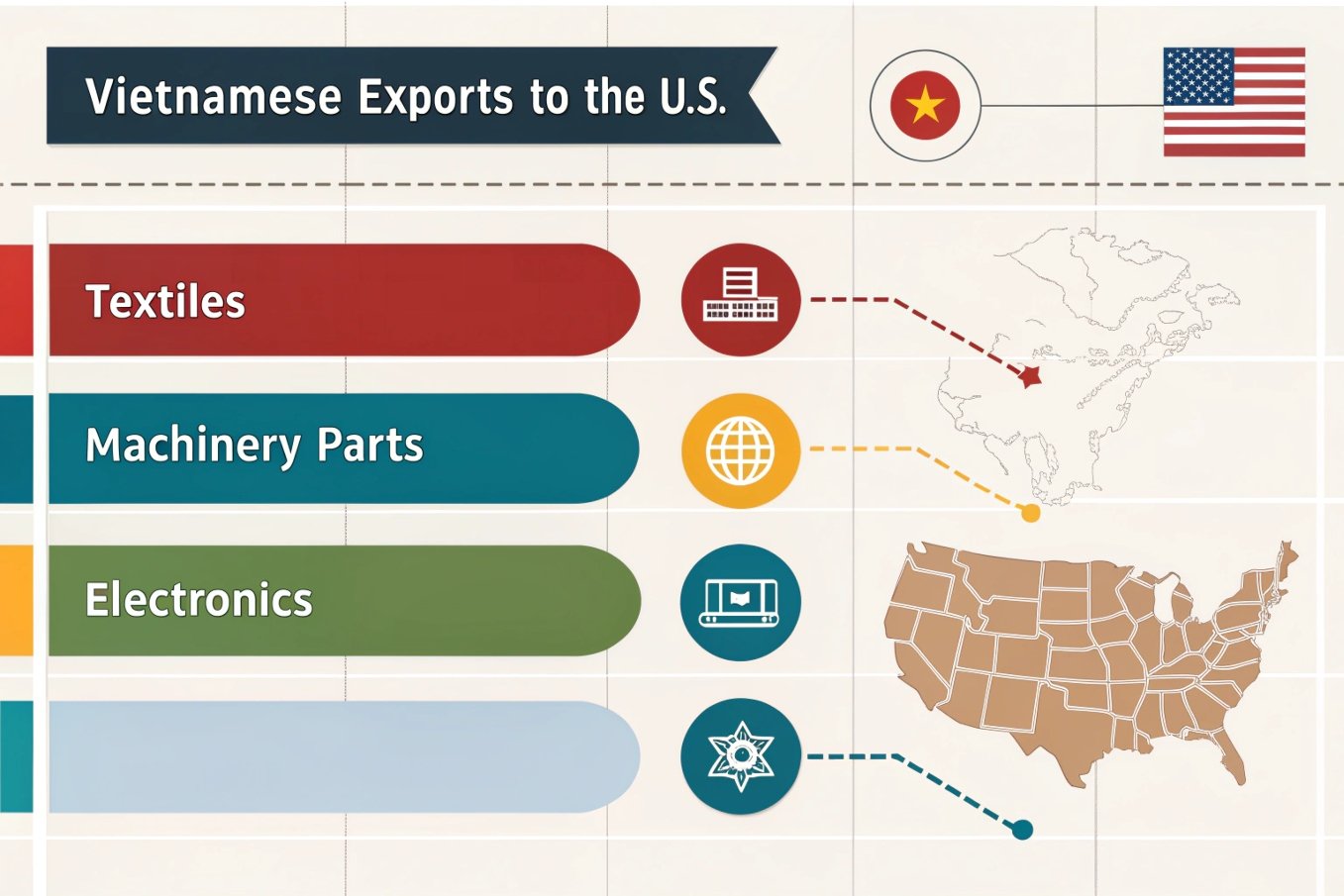

How Do U.S. Tariffs on Vietnam Exports Vary by Product?

U.S. tariffs on imports from Vietnam are determined based on the Harmonized Tariff Schedule (HTS)1, which classifies products and assigns corresponding duty rates. These rates can range from zero to significant percentages, depending on the product type.

For instance, many consumer electronics imported from Vietnam may enter the U.S. duty-free, while textiles and apparel often face higher tariffs, sometimes exceeding 15%. Agricultural products also vary, with some enjoying low tariffs and others subject to higher rates.

It's essential for exporters to consult the HTS to determine the specific tariff rate applicable to their products. The U.S. International Trade Commission provides an online tool to search for tariff information by product code or description.

Examples of U.S. Tariffs on Vietnamese Exports:

| Product Category | Typical Tariff Rate | Notes |

|---|---|---|

| Consumer Electronics | 0% | Many items enter duty-free |

| Textiles and Apparel | 15% or higher | Subject to higher tariffs due to trade policies |

| Agricultural Products | Varies | Rates depend on specific product classifications |

Understanding these variations is crucial for pricing and competitiveness in the U.S. market.

Are There Any U.S. Tariff Exemptions for Vietnamese Exports?

Yes, there are instances where Vietnamese exports to the U.S. may qualify for reduced tariffs or exemptions. One notable program is the Generalized System of Preferences (GSP)2, which aims to promote economic growth in developing countries by providing preferential duty-free entry for specific products.

However, as of the latest updates, Vietnam is not a beneficiary of the GSP program. Therefore, most Vietnamese exports do not qualify for GSP benefits.

Additionally, certain trade agreements or temporary measures can influence tariff rates. For example, in June 2022, the U.S. announced a temporary exemption from new tariffs on solar cells and modules imported from Vietnam, recognizing the country's role in the solar supply chain.

Key Points on Tariff Exemptions:

- Generalized System of Preferences (GSP): Vietnam is currently not a beneficiary.

- Product-Specific Exemptions: Temporary measures may apply to certain products, such as solar panels.

Exporters should stay informed about current trade policies and consult with trade experts to identify potential exemptions.

How Can Businesses Reduce Tariff Costs When Exporting to the U.S.?

Businesses can employ several strategies to mitigate the impact of tariffs on exports to the U.S.:

Product Classification3: Ensure accurate classification of products under the HTS to avoid misclassification, which can lead to higher tariffs or penalties.

Free Trade Zones (FTZs)4: Utilize FTZs in the U.S. where goods can be imported, stored, and processed with deferred or reduced tariffs until they enter the U.S. market.

Tariff Engineering5: Modify products or their assembly processes to qualify for lower tariff rates. This must be done in compliance with legal standards and regulations.

Stay Informed on Trade Policies: Regularly monitor changes in trade agreements, tariff schedules, and exemptions that may affect your products.

Consult Trade Experts: Engage with customs brokers or trade consultants who can provide guidance on minimizing tariff liabilities and ensuring compliance.

Strategies to Reduce Tariff Costs:

| Strategy | Description |

|---|---|

| Product Classification | Accurate HTS classification to ensure correct tariff application |

| Free Trade Zones (FTZs) | Leverage FTZs to defer or reduce tariffs |

| Tariff Engineering | Adjust product design or assembly to qualify for lower tariffs |

| Monitor Trade Policies | Keep abreast of policy changes that may offer new exemptions or reductions |

| Consult Trade Experts | Seek professional advice for compliance and optimization |

By implementing these strategies, businesses can better manage costs associated with tariffs and enhance their competitiveness in the U.S. market.

Conclusion

Tariff rates for Vietnamese exports to the U.S. vary by product, with some goods facing higher duties than others. While general exemptions are limited, businesses can explore strategies such as accurate product classification, utilizing free trade zones, and staying informed about policy changes to reduce tariff costs. Proactive management of these factors is essential for successful exporting to the U.S.

Understanding the HTS is crucial for exporters to navigate tariff rates effectively. Explore this resource for detailed insights. ↩

The GSP can significantly affect tariff rates for eligible countries. Learn more about its implications for trade. ↩

Learning about product classification can prevent costly misclassifications and ensure you pay the correct tariffs, saving money. ↩

Exploring this resource will provide insights into how FTZs can significantly lower tariff costs for your business. ↩

Understanding Tariff Engineering can help you modify products effectively to qualify for lower tariffs, enhancing your profitability. ↩