I used to think sourcing outside China would automatically reduce my import costs. But in 2025, things changed. A 71% tariff on Vietnamese steel parts nearly doubled my landed price.

As of 2025, importing custom metal parts from Vietnam to the U.S. incurs tariffs as high as 71%–96%, while imports from China currently face a reduced 30% tariff under a temporary trade truce 1.

Let’s break down what’s driving this dramatic reversal—and how you can manage the risks and costs.

How have U.S. tariffs on Vietnamese metal parts changed recently?

We used to count on Vietnam as a lower-cost alternative to China. But this year, one of my clients got hit with a surprise 46% “reciprocal tariff” on top of standard metal duties.

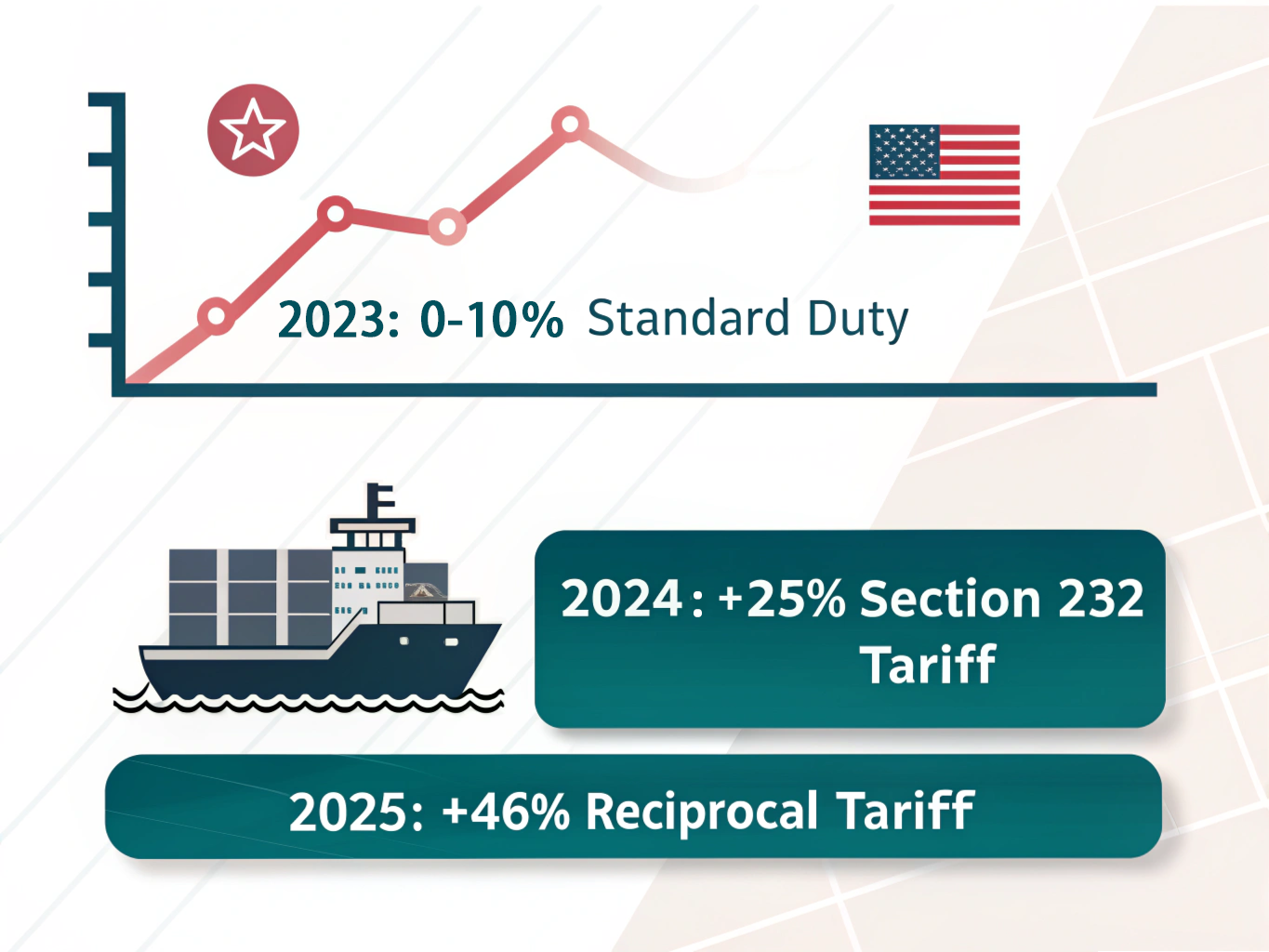

In mid-2025, the U.S. imposed a 46% reciprocal tariff on Vietnamese exports 2, including custom steel parts, in response to trade imbalances. Combined with the 25–50% Section 232 tariff 3, total duties can reach up to 96%.

Breakdown of Current U.S. Tariffs on Vietnamese Metal Parts

| Tariff Type | Rate | Applies to |

|---|---|---|

| Section 232 | 25%–50% | All steel and aluminum imports |

| Reciprocal Tariff (2025) | 20%–46% | Products from Vietnam, including custom parts |

| Total Effective Tariff | Up to 96% | Custom metal parts from Vietnam |

These changes took effect around July 1, 2025, as part of a broader trade framework adjustment. The original 46% was later adjusted down to 20% for compliant goods—but the risk remains if your parts are flagged for transshipment or fail origin verification 4.

This puts Vietnam in a new position: higher tariffs than China, reversing years of cost advantage.

Why are tariffs on Chinese metal imports significantly higher?

When we used to import from China, we braced for triple-digit tariffs. In 2025, however, we were shocked to see a temporary reduction.

Chinese metal parts are still subject to Section 232 and Section 301 tariffs—but due to a trade truce in 2025, total tariffs have been temporarily reduced to approximately 30% for a 90-day period 5.

Typical Tariff Profile for Chinese Metal Parts (Mid-2025)

| Tariff Type | Rate | Applies to |

|---|---|---|

| Section 232 | 25% | Steel and aluminum imports |

| Section 301 | 5%–30% | Based on origin and classification |

| Combined Effective Tariff | \~30% | During 90-day reduction window |

While these reductions are temporary, they’ve shifted sourcing strategies back toward China for some buyers—especially for short-term orders or projects with thin margins.

But this is just a pause. Section 301 and 232 tariffs still legally apply, and unless extended, the rate will climb back up after the truce ends.

How do transshipment rules affect Vietnam-to-U.S. imports?

One of our U.S. customers had a shipment from Vietnam detained at customs. Why? The parts were traced back to a Chinese-origin billet with only minor machining done in Vietnam.

If a product made in China undergoes only minor assembly in Vietnam, it does not qualify as Vietnamese origin 6. Such transshipped goods can trigger a 40% penalty tariff under U.S. enforcement rules.

What strategies reduce tariff impact on custom metal parts?

With tariffs changing fast, we had to update our sourcing playbook. I’ll share a few tactics we now use to minimize landed costs and avoid legal pitfalls.

To reduce tariff impact, ensure full transformation in Vietnam, keep clean origin documentation, monitor tariff changes, and diversify sourcing when needed 7.

Conclusion

Vietnam is no longer a tariff-free haven. Chinese parts might look cheaper short-term, but risks remain. Know the rules, verify origin, and audit your supply chain to avoid surprises at customs.

Footnotes

Overview of U.S. tariff changes on Chinese and Vietnamese metal parts (Bloomberg, 2025). ↩

Trade deal details on the 46% reciprocal tariff applied to Vietnamese imports (IndiaTimes, 2025). ↩

Section 232 tariff increase on steel and aluminum imports to 50% (Barron’s, June 2025). ↩

Reuters coverage of Vietnam’s revised 20% tariff deal and penalties for origin violations. ↩

Section 301 & 232 tariff truce effects on Chinese steel part imports (Trade Compliance Resource Hub). ↩

U.S. Customs rules on substantial transformation and penalties for transshipment (USTR.gov). ↩

Strategies for reducing landed cost through sourcing and documentation (DSV Global Insights). ↩