When I first started importing steel parts, I lost thousands from currency fluctuations. I learned the hard way that good sourcing is worthless without currency risk control.

To reduce forex risk when importing custom steel parts, importers should use tools like forward contracts, options, and currency swaps, while strategically planning payments and invoicing in stable currencies like USD.1

Let’s explore how to build a simple but strong currency risk management plan.

What are the best currency hedging tools for importers?

I used to hope the exchange rate would swing in my favor. That strategy failed—until I started using proper hedging tools.

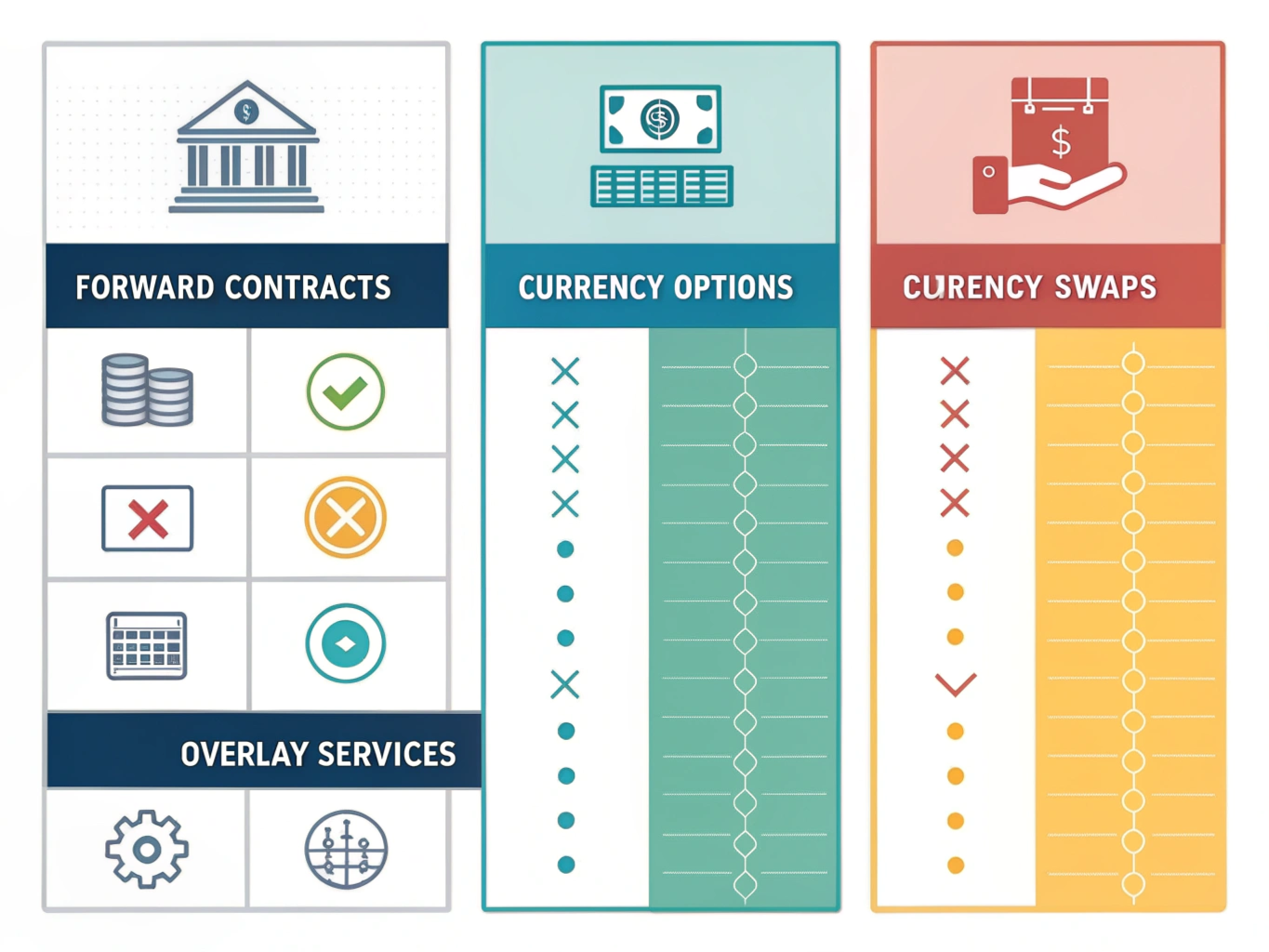

The best forex hedging tools include forward contracts, options, swaps, and currency overlay services. Each allows importers to fix or manage exchange rates for future payments.2

Comparison of Hedging Tools

| Tool | How It Works | Ideal For |

|---|---|---|

| Forward Contract | Locks in an exchange rate for a future transaction | Predictable payments within set timelines |

| Currency Option | Right (not obligation) to exchange at a set rate | Volatile markets with potential upside |

| Currency Swap | Agreement to exchange currencies over time | Large or ongoing import projects |

| Currency Overlay | Third-party manages all FX risks dynamically | Frequent multi-currency deals |

Can forward contracts protect against exchange losses?

One of my biggest regrets was not locking the exchange rate before placing a large order. It cost me over 8% in margin.

Yes, forward contracts are among the most effective ways to protect against exchange losses. They fix the currency rate in advance, removing uncertainty from future payments.3

Key Features of Forward Contracts

- Lock-in period: Common durations include 30, 60, 90, or 180 days

- Customizable: Matches import invoice or PO date

- No upfront cost: But may incur margin if rate swings significantly

- Bank involvement: Offered by corporate or trade finance banks

Should I invoice in local or foreign currency?

I always ask suppliers to quote in USD. It saves me the headache of tracking five currency markets at once.

Importers should invoice in USD or their home currency to shift exchange risk onto the supplier. This simplifies accounting and shields profit margins.4

Currency Choice Strategy

| Invoice Currency | Who Bears FX Risk | When It Makes Sense |

|---|---|---|

| USD | Supplier | Most global steel transactions |

| Home Currency | Supplier | Stable economies with strong currencies |

| Supplier Currency | Buyer | If buyer has FX hedge capability |

How do importers plan payments amid currency swings?

Sometimes I delay payment for two days—and gain 2% on FX. Other times I prepay to avoid an adverse move.

Importers plan payment timing using lead/lag strategies, foreign currency accounts, and hedge ratio management to minimize losses.5

Smart Timing Techniques

- Lead payments: Pay early when currency is favorable

- Lag payments: Delay when expecting currency improvement

- FX accounts: Hold balances in USD, EUR, or VND to choose timing

- Partial settlements: Split large payments to average rates

What is a hedge ratio and why does it matter?

A hedge ratio balances protection with flexibility. I hedge 80% of my expected expenses and leave some open upside.

A hedge ratio is the portion of total exposure you lock in—e.g., hedging 80% of a \$100,000 shipment with forwards.6

| Total Exposure | Hedged Amount | Hedge Ratio |

|---|---|---|

| \$100,000 | \$80,000 | 80% |

| \$200,000 | \$150,000 | 75% |

| \$50,000 | \$25,000 | 50% |

Conclusion

By combining rate locks (forwards, options), invoicing in USD, strategic payment timing, and partial hedging, importers can significantly reduce forex exposure and protect margins when importing custom steel parts.

Footnotes

Study on importers using forwards, options & swaps to manage cross-border currency risk. ↩

Bank of England guide on corporate hedging tools (forwards, options, swaps, overlays). ↩

HSBC explains forward contracts and FX risk mitigation. ↩

Investopedia article on invoicing currency choice and FX risk allocation. ↩

CFA Institute case study on lead/lag payment strategies in cross‑border trade. ↩

FXStreet overview of hedge ratio and its application in import finance. ↩