Ensuring compliance with trade agreements is crucial for businesses importing custom steel parts. It’s essential to understand how U.S. trade policies, such as those with China, the EU, or Mexico, impact the cost, documentation, and logistics of your imports.

In this article, we’ll guide you through how these trade agreements impact steel imports, how to take advantage of tariff reductions, ensure your supplier documentation aligns with these agreements, and adjust your strategies if policies change.

As an importer, staying compliant with trade agreements ensures you avoid unnecessary costs, legal penalties, and disruptions in your supply chain. Let’s dive into the specifics.

How do these trade agreements impact steel imports?

Trade agreements like U.S.-China, U.S.-EU, and U.S.-Mexico impact steel imports by affecting tariff rates, compliance requirements, and cost structure. Understanding these impacts is crucial for businesses to stay competitive in the market.

The impact of trade agreements on steel imports is substantial. Trade agreements like the U.S.-China, U.S.-EU, and U.S.-Mexico trade pacts affect the tariffs imposed on imported steel parts. These agreements include different tariff rates and import requirements based on the country of origin of the goods.

For instance, steel parts imported from China are subject to Section 232 tariffs of 25% as well as Section 301 tariffs, which can total up to 170% in duties, depending on the type of product. Meanwhile, steel imports from the EU face Section 232 tariffs of 25%, but with additional countermeasures applied by the EU. In contrast, steel imports from Mexico under the USMCA can qualify for preferential tariff treatment, provided they meet the necessary criteria such as regional content requirements and a "melted and poured" standard.

In essence, these agreements can significantly affect the cost structure of imported steel parts, depending on the country of origin and whether the products meet specific rules of origin (RoO) requirements.

Dive deeper: Understanding Rules of Origin (RoO)

To ensure your steel imports comply, it’s important to understand the Rules of Origin (RoO), which dictate how a product’s origin is determined. These rules vary across trade agreements but are critical for determining eligibility for reduced tariffs or exemptions.

U.S.-China Trade Agreement

Steel products from China often face hefty tariffs. Under the U.S.-China trade framework, steel products originating from China are subject to a combination of tariffs, including Section 232 tariffs (25%) and Section 301 tariffs, which could push duties as high as 170%. Therefore, it is essential to precisely determine the origin of the steel parts before importing to avoid these significant duties.

U.S.-EU Trade Agreement

The U.S. imposes Section 232 tariffs on steel products imported from the EU. While the tariffs may seem high at 25%, the EU has imposed countermeasures, including additional duties on certain U.S. goods. This creates an additional layer of complexity when importing from the EU. Knowing the specific tariff classifications for different types of steel parts will help avoid unexpected costs and penalties.

U.S.-Mexico Trade Agreement

For imports from Mexico under the USMCA, steel products must meet certain RoO criteria. These include requirements for regional content, and the product must often be made from steel that is "melted and poured" in North America. This allows the steel parts to qualify for duty-free treatment if the origin requirements are met.

By ensuring that your steel parts adhere to these rules, you can minimize costs and avoid potential penalties.

| Country | Tariff Rate (Section 232) | Additional Tariffs | RoO Requirements |

|---|---|---|---|

| China | 25% | Up to 25% (Section 301) | Cumulative duties up to 170% |

| EU | 25% | Countermeasures for U.S. products | Varies per product |

| Mexico (USMCA) | 0% (if RoO met) | None | Must meet regional content and "melted and poured" criteria |

Are there tariff reductions or benefits available?

There are several tariff reductions or benefits available, particularly for steel imports from Mexico under the USMCA, provided they meet the required Rules of Origin (RoO). Steel imports from China and the EU may also qualify for reduced duties under specific conditions.

Tariff reductions or benefits are available under specific conditions in trade agreements. Steel products from countries like Mexico can benefit from preferential tariff treatment under the USMCA, provided they meet the RoO criteria. These benefits can significantly reduce the import costs for companies sourcing from North America.

For steel products from China and the EU, the scope of tariff reductions is more limited, but understanding whether certain steel parts qualify for exemptions or reduced duties is critical. Often, tariff reductions depend on the precise classification of the steel parts or if they meet specific manufacturing criteria.

Dive deeper: How to Leverage Tariff Benefits

U.S.-China and U.S.-EU Tariff Exemptions

There are some exemptions to tariffs for steel parts from China and the EU, but these are typically very specific. To qualify for exemptions or reductions, the imported steel parts need to meet certain conditions outlined in the agreements. For example, the U.S. has certain product-specific exclusions for steel products from China, which can be used to reduce the impact of tariffs.

In the case of the EU, there are ongoing negotiations for tariff relief on certain products. The U.S. and EU are working on frameworks for reducing these tariffs in the future, but for now, the tariffs remain a significant cost consideration.

U.S.-Mexico Preferential Tariffs under USMCA

For Mexico, the USMCA allows for steel imports that meet the RoO to enter the U.S. duty-free or with reduced duties. To qualify, the steel parts must meet the regional content requirement, meaning a certain percentage of the product must come from North America (the U.S., Canada, or Mexico). Additionally, the steel parts must meet the "melted and poured" requirement, meaning they must be produced in one of these countries.

By understanding these specific provisions, you can adjust your sourcing strategies to reduce your tariff burden when importing steel parts from Mexico.

| Country | Tariff Reductions Available | Conditions for Tariff Reduction |

|---|---|---|

| China | Limited product exemptions | Product-specific exclusions |

| EU | Negotiating tariff relief | Pending reduction on specific products |

| Mexico (USMCA) | Duty-free or reduced tariffs | Must meet regional content and "melted and poured" criteria |

How to ensure supplier documentation aligns with trade agreements?

Accurate supplier documentation, including Certificates of Origin and Bills of Materials, is essential to ensure compliance with trade agreements. Without the proper documentation, steel parts may not qualify for tariff reductions, and customs clearance could be delayed or denied.

Ensuring that supplier documentation is accurate and aligns with trade agreements is crucial for compliance. You need to obtain detailed certificates of origin and other documentation that demonstrate the origin of the steel parts. Without proper documentation, your importation might not qualify for tariff reductions or could even be subject to penalties and retroactive duties.

Documentation, such as Certificates of Origin and Bills of Materials, should specify the country of origin, the HS code of the product, and the specific RoO criteria that are met. Suppliers must provide clear and precise documentation to avoid customs issues.

Dive deeper: Best Practices for Managing Supplier Documentation

Certificates of Origin

A Certificate of Origin is one of the most important documents for proving the origin of your steel parts. It provides the necessary evidence that the products meet the origin criteria under a specific trade agreement. This certificate should include the HS code, description of the product, and the criteria for meeting the RoO.

Bill of Materials (BOM)

A BOM is another important document that provides detailed information about the components used in the steel parts. This is particularly useful for verifying the country of origin of each material used in manufacturing the steel parts. The BOM can help ensure that all parts comply with the RoO by proving that the materials used originate from eligible countries.

Supplier Declarations

Some trade agreements, like the USMCA, may require suppliers to provide a declaration of origin. This declaration affirms that the steel parts meet the required criteria for preferential tariff treatment. Suppliers should be able to provide this declaration upon request to ensure smooth customs clearance.

| Document Type | Purpose | Requirements |

|---|---|---|

| Certificate of Origin | Proves the origin of steel parts | Includes HS code and product description |

| Bill of Materials (BOM) | Verifies material sources and origin of components | Should list each material’s origin |

| Supplier Declaration | Affirms compliance with trade agreement rules | Declaration of origin for tariff purposes |

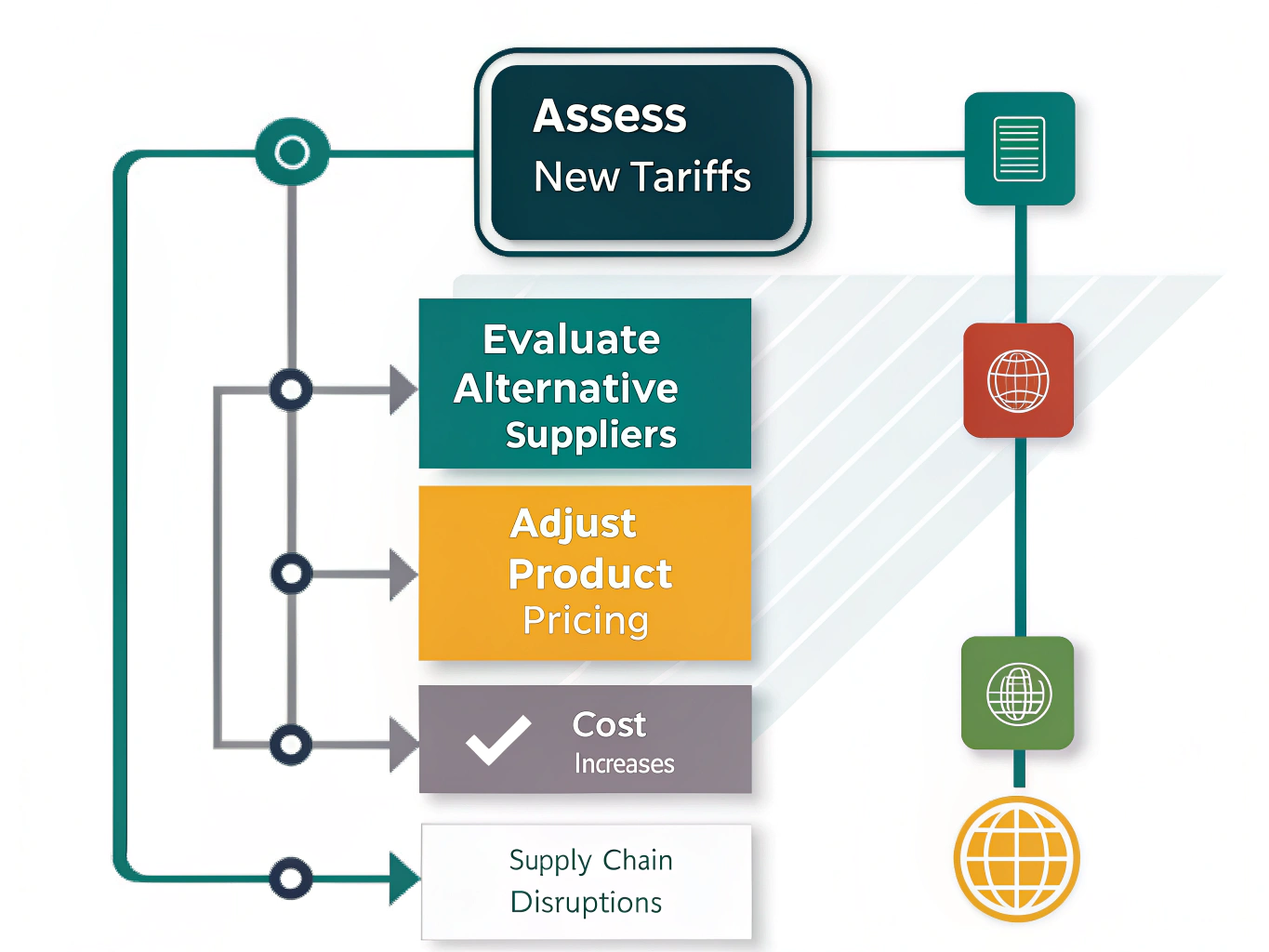

How to adjust import strategies if trade policies change?

Adapting your import strategies to evolving trade policies is key to maintaining cost-effectiveness and ensuring compliance. Monitoring policy changes and adjusting sourcing strategies can help you minimize risks associated with new tariffs or changes in trade agreements.

Trade policies are subject to frequent changes, especially in countries with evolving tariff structures and trade agreements. The U.S. regularly revises its tariffs and trade rules, so it’s essential to stay informed about any changes that could impact the cost or legality of your imports.

Adapting your strategy requires understanding the new policies and adjusting your sourcing decisions accordingly. If tariffs increase, you might want to shift sourcing to countries with more favorable trade conditions. Similarly, if preferential treatment for a certain country is reinstated, you can take advantage of lower costs by switching suppliers or renegotiating terms with your existing suppliers.

Dive deeper: Strategies for Adjusting to Trade Policy Changes

Monitor Trade Policy Developments

To stay ahead of any policy changes, it’s important to regularly monitor news about trade agreements. Government websites, industry news, and trade compliance services can provide timely updates on tariff changes or new trade deals.

Develop Alternative Sourcing Strategies

When tariffs increase, consider sourcing steel parts from countries that have lower or no tariffs. For example, sourcing from Mexico under the USMCA may provide cost savings compared to sourcing from China or the EU, depending on the tariffs.

Maintain a Flexible Supply Chain

Having a flexible supply chain allows you to adapt quickly to changes in trade policies. If a tariff increase impacts the cost of your steel parts, you can adjust by finding new suppliers or by switching to products that are less affected by tariffs. This flexibility can help you maintain profitability even during times of political or economic uncertainty.

| Strategy | Description | Benefits |

|---|---|---|

| Monitor Policy Changes | Track changes in tariffs and trade rules | Stay compliant and adjust strategy |

| Source from New Countries | Shift sourcing to countries with favorable tariffs | Lower import costs |

| Flexible Supply Chain | Adapt quickly to changes in tariffs or product requirements | Maintain profitability and continuity |

Conclusion

Navigating the complexities of trade agreements and tariffs is essential for any business importing custom steel parts. By staying informed about the rules and policies for U.S.-China, U.S.-EU, and U.S.-Mexico trade agreements, ensuring accurate supplier documentation, and adapting to changing trade policies, you can optimize your import strategies and minimize costs.