When comparing delivery times between Vietnamese and Chinese suppliers, it’s important to understand the key factors that influence these timelines. While both countries have their advantages in terms of production capabilities, there are significant differences that impact lead times. Understanding these differences can help you manage your expectations and supply chain planning effectively.

Vietnamese suppliers typically have longer lead times than Chinese suppliers due to factors such as labor culture, skill levels, and reliance on imports for raw materials. Understanding these differences can help you plan better and avoid delays in your production schedule.

This article explains why Vietnamese suppliers often have longer lead times, and how to manage the potential risks involved.

Why Do Vietnamese Suppliers Often Have Longer Lead Times than Chinese Suppliers?

There are several reasons why Vietnamese suppliers typically have longer lead times compared to their Chinese counterparts. These include differences in labor practices, skill levels, and supply chain dependencies1.

Vietnamese workers generally do not work overtime as frequently as their Chinese counterparts, leading to slower production speeds. Additionally, Vietnam has fewer skilled workers2, which affects overall production efficiency. Furthermore, many Vietnamese suppliers rely on China for raw materials and components, causing additional delays in the supply chain.

In Vietnam, labor laws and practices are stricter when it comes to overtime work. Many Vietnamese workers work fixed hours and are not as accustomed to extended shifts or weekend work compared to workers in China. This limits the overall production capacity, especially in cases where a supplier needs to scale up operations quickly to meet a large order.

Vietnam also faces a shortage of skilled workers in some industries, which affects the speed and quality of production. Skilled labor shortages can cause delays, particularly when the production process requires specialized skills, such as for customized or complex mechanical parts. This is often in contrast to China, which has a much larger pool of skilled workers.

Another critical factor is Vietnam’s reliance on China for raw materials and components. Since Vietnam does not yet have a fully self-sufficient manufacturing ecosystem, many suppliers in Vietnam need to import parts from China. Any delays in shipments from China can directly affect Vietnamese production schedules.

Key Factors Behind Longer Lead Times in Vietnam:

| Factor | Impact on Lead Time | Explanation |

|---|---|---|

| Labor Practices | Limited overtime work | Vietnamese workers have stricter work hours compared to Chinese workers |

| Skill Level | Fewer skilled workers | Skilled labor shortages can slow production speed |

| Supply Chain Dependencies | Reliance on imports from China | Delays in receiving raw materials from China can impact Vietnamese production |

If the Delivery Time Is Extended, How Should I Manage Safety Stock3?

If you’re working with Vietnamese suppliers and face longer delivery times, it’s essential to consider how to manage your inventory and safety stock levels to mitigate risks and ensure production continuity.

Maintaining higher safety stock levels or rethinking your order frequency is a common strategy for managing longer delivery times4. You may also want to work with your supplier to establish a more predictable supply chain and plan for extended lead times.

Safety stock is essentially an extra inventory buffer that protects your business from unexpected delays or fluctuations in supply. If you’re working with a supplier from Vietnam and anticipate longer lead times, consider adjusting your safety stock levels to cover potential delays. Increasing your order frequency or placing orders earlier than usual can also help manage the impact of extended delivery times.

However, while maintaining higher levels of safety stock is one strategy, it’s also important not to overstock, as this can tie up capital and storage space. Working closely with your supplier to forecast demand accurately and establish a more reliable production schedule is key to avoiding unnecessary inventory costs.

Here are a few strategies you can implement:

Safety Stock Strategies for Managing Longer Lead Times:

| Strategy | Benefits | Considerations |

|---|---|---|

| Increase Safety Stock | Reduces risk of stockouts | Requires more storage and higher costs |

| Order Earlier | Provides more time for shipping | Ties up capital in excess inventory |

| Work with Supplier for Better Forecasting | Reduces uncertainty in lead times | Requires strong communication and collaboration with the supplier |

By adjusting your safety stock and improving communication with your supplier, you can help ensure smooth operations, even with longer lead times.

How Long Does Shipping from Vietnam to the US Take?

Shipping times from Vietnam to the US depend on the chosen transport method, the port of departure, and the destination port in the US.

Sea freight from Vietnam to the US typically takes 25 to 35 days, while air freight is faster, taking about 7 to 10 days. The specific timeline varies depending on factors like the port of departure and the destination port in the US.

The most common departure ports in Vietnam are Ho Chi Minh City and Hai Phong, while major arrival ports in the US include Los Angeles, Long Beach, and New York. Depending on the departure and arrival locations, sea freight can take anywhere from 25 to 35 days. Air freight, on the other hand, usually takes between 7 to 10 days.

Sea Freight vs. Air Freight:

| Method | Shipping Time (Typical) | Best for | Cost Comparison |

|---|---|---|---|

| Sea Freight | 25 – 35 days | Large, bulk shipments | Low-cost, slower |

| Air Freight | 7 – 10 days | Urgent, high-value goods | High-cost, faster |

Understanding these shipping times will help you plan your inventory and manage customer expectations accordingly.

How Long Does Shipping from Vietnam to Europe (Such as Netherlands) Take?

Shipping from Vietnam to Europe, including countries like the Netherlands, generally takes longer than shipping to the US, primarily due to the distance and the complexity of European logistics.

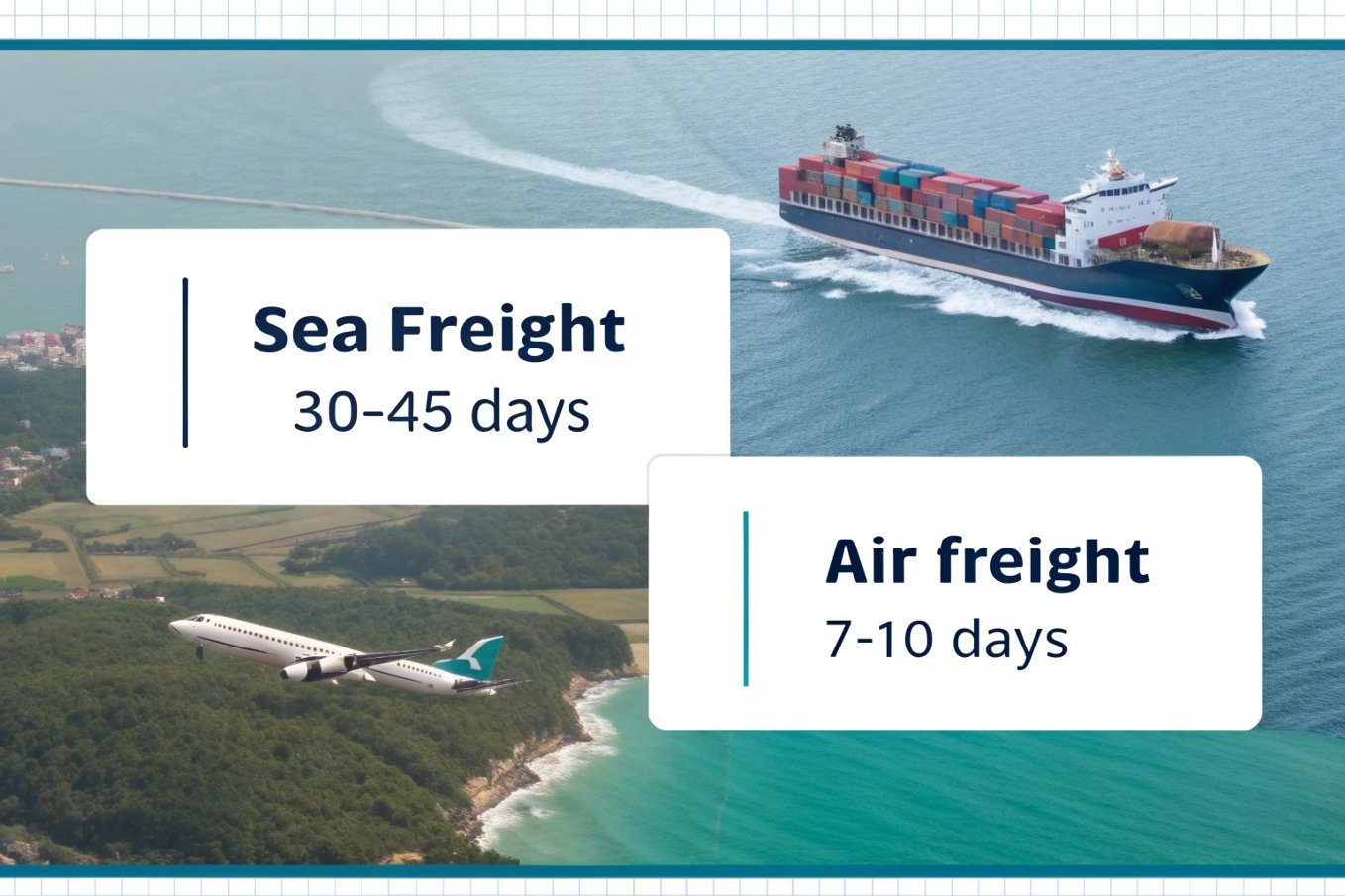

Sea freight from Vietnam to Europe typically takes 30 to 45 days, depending on the port of departure and the arrival port in Europe. Air freight can be completed in about 7 to 10 days, but it’s a more expensive option.

For sea freight, common departure ports include Ho Chi Minh City and Hai Phong, while key arrival ports in Europe include Rotterdam (Netherlands), Hamburg (Germany), and Antwerp (Belgium). Depending on the exact route, sea freight can take anywhere from 30 to 45 days.

If you need faster delivery, air freight can reduce shipping time to about 7 to 10 days, but it comes at a significantly higher cost.

Shipping Times for Vietnam to Europe:

| Method | Shipping Time (Typical) | Best for | Cost Comparison |

|---|---|---|---|

| Sea Freight | 30 – 45 days | Large, bulk shipments | Low-cost, slower |

| Air Freight | 7 – 10 days | Urgent, high-value goods | High-cost, faster |

By understanding these shipping times, you can adjust your orders and manage expectations accordingly.

Conclusion

Vietnamese suppliers often have longer lead times compared to Chinese suppliers due to factors such as labor practices, skill shortages, and supply chain dependencies. Understanding these challenges and managing safety stock levels can help mitigate potential delays. By staying proactive in your inventory planning and communication with suppliers, you can better manage extended delivery times and ensure timely delivery of your goods.

-

Learning about supply chain dependencies can help you identify potential risks and improve your sourcing strategies. ↩

-

Exploring the role of skilled workers can provide insights into improving production efficiency and addressing labor shortages. ↩

-

Understanding safety stock is crucial for managing inventory effectively, especially with longer lead times. Explore this resource to enhance your knowledge. ↩

-

Learn effective strategies to manage inventory during extended delivery times, ensuring production continuity and minimizing risks. ↩