When I first began handling customs for imported steel parts, I made the mistake of assuming that the shipping company would "handle everything." After a costly fine due to a simple classification error, I realized the responsibility was mine. Since then, I’ve put systems in place to double-check all documentation and duty calculations—and I haven’t received a penalty since.

Importers of custom steel parts can avoid customs fines by using the correct HTS classification 1, declaring accurate values and origins, maintaining clear documentation, and regularly auditing entries. Misclassification, undervaluation, and missing tariffs are the most common errors that lead to penalties.

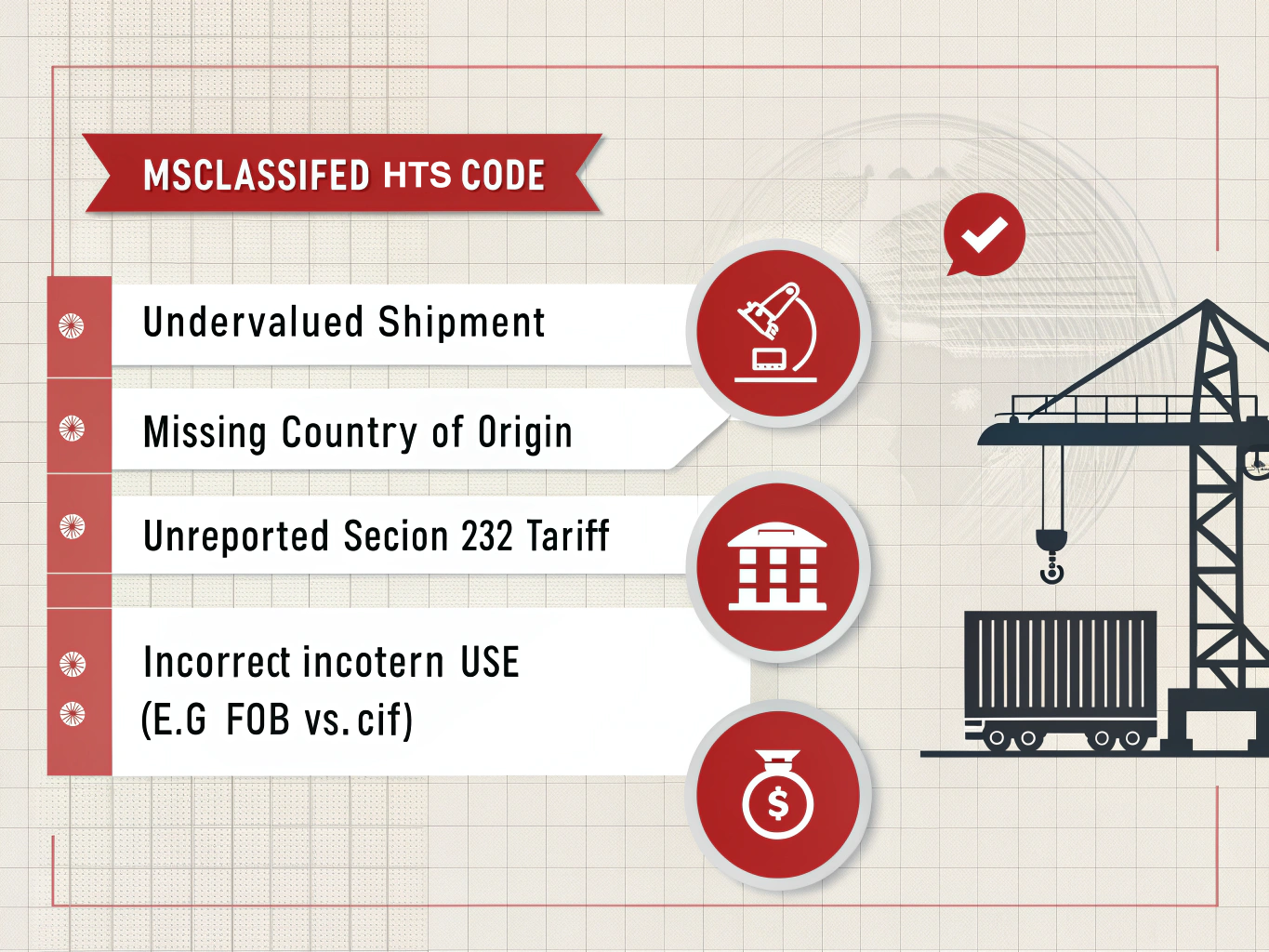

What Are Common Customs Declaration Mistakes Importers Should Avoid?

Common customs declaration mistakes include misclassifying products, undervaluing shipments, failing to declare country of origin, omitting applicable tariffs (like Section 232), and inconsistent use of Incoterms. Each of these errors can trigger financial penalties or shipment delays.

Top Errors to Watch For

- HTS Code Errors: Applying the wrong tariff code leads to under- or overpaying duties.

- Incorrect Transaction Value: Declaring less than the actual CIF value is considered fraud.

- Origin Misstatement: Misstating the country of origin violates U.S. import law and can lead to AD/CVD misapplication.

- Ignoring Section Tariffs: Not declaring Section 232 or 301 duties can result in retroactive charges and penalties.

- Mismatch in Incoterms: Inconsistencies between invoice, Bill of Lading, and customs entries confuse customs and trigger red flags.

| Mistake Type | Description | Consequence |

|---|---|---|

| HTS Misclassification | Wrong tariff code used | Underpayment/overpayment + penalty |

| Value Misdeclaration | Declaring incorrect price or omitting shipping/insurance | Fines or seizure |

| Tariff Omission | Missing Section 232, 301, or AD/CVD tariffs | Retroactive duty assessment |

| Inconsistent Incoterms | Differences across invoice, declaration, and shipment | Delay or denial of entry |

| Documentation Errors | Missing or inaccurate packing lists, invoices | Audit risk or import denial |

How Does the Harmonized Tariff Schedule (HTS) Classification Impact Customs Compliance?

HTS classification is the foundation of customs compliance because it determines duty rates, eligibility for Free Trade Agreements, and whether AD/CVD or Section tariffs apply. Errors in classification can result in paying the wrong amount of duties or misapplying regulatory conditions.

Importance of HTS Accuracy

- Tariff Rate Calculation: Incorrect codes lead to incorrect duty amounts.

- FTA Eligibility: Only certain HTS codes qualify under specific FTAs like USMCA or KORUS.

- Trade Remedy Measures: The HTS code determines whether Section 232, Section 301, or AD/CVD applies.

Best Practices for HTS Classification

| Action | Why It Matters |

|---|---|

| Use Binding Rulings 2 | Ensures long-term classification accuracy |

| Consult CROSS Rulings | Learn from CBP’s past decisions on similar items |

| Maintain Specs and Drawings | Provide support for chosen code during audits |

| Validate with Customs Broker | Gain expert verification |

What Are the Consequences of Misclassifying Imported Goods Under U.S. Customs Law?

Misclassifying imported goods can lead to penalties ranging from additional duties to severe civil fines, seizure of goods, or even criminal charges in cases of fraud. CBP audits can review multiple years of import records, leading to retroactive penalties.

Penalty Levels Based on Misconduct

| Violation Type | Penalty Type | Amount or Scope |

|---|---|---|

| Negligence | Civil fine | Up to 2× the duty lost |

| Gross Negligence | Civil fine | Up to 4× the duty lost |

| Fraud | Civil + Criminal | Seizure, loss of import privileges |

| Systemic Misclassification | CBP Audit and Ongoing Scrutiny | Costly compliance reviews |

Examples of Costly Mistakes

- Wrong HTS for alloy steel parts: Underreported duty → $10,000+ in back payments

- FTA Misuse on Non-Originating Product: Full duty owed + denial of FTA privileges

- Missed Section 232: $50,000+ in retroactive tariffs plus penalties

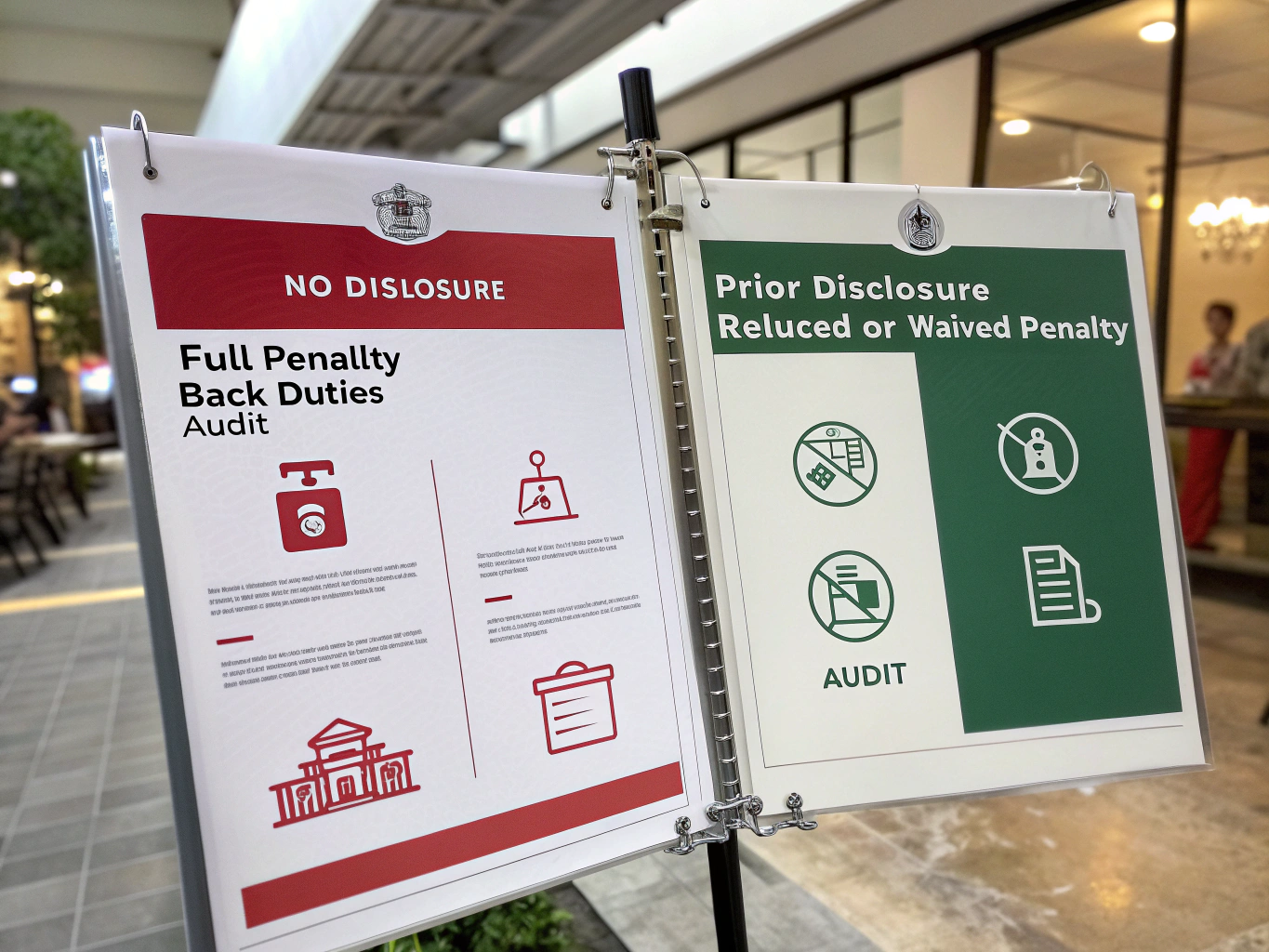

How Can Prior Disclosure Help Mitigate Penalties for Customs Violations?

Prior disclosure 3 allows importers to voluntarily report violations before U.S. Customs discovers them, potentially reducing or eliminating penalties. This tool encourages companies to correct past mistakes and demonstrate good faith compliance.

How Prior Disclosure Works

- Self-Review: Company audits past customs entries.

- Identify Errors: Misclassifications, omissions, or incorrect values are documented.

- Notify CBP in Writing: Submit a letter explaining the error and providing corrected data.

- Pay Back Duties: Submit the correct amount owed.

- Avoid Penalties: CBP may waive penalties if disclosure is timely and complete.

When to Use Prior Disclosure

| Situation | Disclosure Recommended? | Reason |

|---|---|---|

| Multiple HTS misclassifications | Yes | Prevent penalty for systemic negligence |

| FTA errors | Yes | Show voluntary correction effort |

| Underreported values | Yes | Avoid fraud penalties |

| Tariff exclusions improperly applied | Yes | Helps reset compliance |

Conclusion

Importers of custom steel parts can avoid costly customs fines by accurately classifying goods, declaring true values and origins, maintaining organized documentation, and proactively addressing errors through prior disclosure. Working closely with a licensed customs broker or trade attorney ensures compliance and reduces long-term risks.