Sometimes I need to purchase high‑value custom steel parts, but I don’t want to freeze my working capital. This is where import finance comes in—it helps me keep operations moving.

Yes, buyers can finance custom steel parts imports using a range of trade finance solutions 1 such as Letters of Credit, buyer’s credit, supply chain finance, and invoice financing. These tools help fund purchases, reduce upfront costs, and manage cash flow efficiently.

If you’re importing custom mechanical parts from overseas, especially in large volumes or with complex production requirements, you can use financing tools that reduce risk and improve supplier trust. Let’s break down the options and see how they apply.

What loan options exist for international purchases?

Sometimes I get quotations from overseas suppliers that require a high percentage of prepayment. I don’t always have that cash available upfront, so I need a solution.

Importers can access international purchase loans through instruments like Letters of Credit (L/C) 2, Standby L/Cs, buyer’s credit, and bank guarantees 3. These help ensure payment to suppliers while allowing buyers to delay outflows.

Many banks and trade finance providers 4 offer customized loan products for international procurement. These tools serve two roles—they protect suppliers and provide liquidity to buyers.

Types of International Purchase Financing

| Financing Tool | Purpose | Benefit to Buyer |

|---|---|---|

| Letter of Credit (L/C) | Guarantees supplier payment after shipment | Builds supplier trust, delays buyer’s payment |

| Buyer’s Credit | Allows borrowing from foreign banks | Low‑interest loans tied to LIBOR or SOFR |

| Bank Guarantee | Assures supplier of payment even if buyer defaults | Enhances deal credibility |

| Standby L/C | Backup payment method if buyer fails to pay | Acts as a safety net for the supplier |

These tools let buyers fund full import costs—including freight, taxes, and duties—without cash. Some programs even support zero‑collateral options depending on your credit rating or transaction volume.

Can trade finance help fund steel parts procurement?

When I need to place large orders for steel parts, I can’t always afford delays in supplier production. That’s when trade finance structures 5 like supply chain finance, buyer’s credit, and forfaiting provide the capital needed for steel parts procurement, ensuring suppliers are paid on time and production doesn’t stop.

Trade finance focuses on funding cross‑border transactions in a way that’s secure for both buyers and suppliers. For custom steel parts—which often require tooling, long lead times, and high precision—suppliers usually won’t start production without a payment guarantee 6.

Trade Finance Options for Steel Parts

| Trade Finance Type | How It Works | Best For |

|---|---|---|

| Supply Chain Finance | Bank pays supplier early; buyer pays later | Cash flow relief and better payment terms |

| Forfaiting | Sale of receivables from medium‑term contracts | High‑value, long‑term capital goods imports |

| Credit Insurance + L/C | Covers default risk and ensures L/C execution | Transactions with unfamiliar suppliers |

Steel parts buyers benefit most from structured solutions that match cash inflows with supplier due dates. This is especially true when the parts are custom‑made and production lead times are long.

How do importers qualify for purchase order financing?

Sometimes, I get a confirmed order from my client, but I don’t have the funds to start production with my supplier. That’s when purchase order (PO) financing 7 can help bridge the gap.

PO financing is based on your customer’s commitment. If you have a firm order from a creditworthy client, trade financiers will use that to fund your supplier payment, even before you’ve delivered the goods.

Key Requirements for PO Financing

| Requirement | Why It Matters |

|---|---|

| Verified End Customer | Lenders reduce risk if the buyer is creditworthy |

| Approved Supplier | The supplier must have a history of timely delivery |

| Profit Margin Visibility | Lenders want to ensure you can repay them |

| Defined Payment Terms | Clear PO details reduce ambiguity and risk |

Some financiers offer this without requiring personal guarantees or collateral, especially if the supply chain involves reputable companies. The funds are usually disbursed directly to the supplier, ensuring proper use.

Is invoice financing suitable for steel imports?

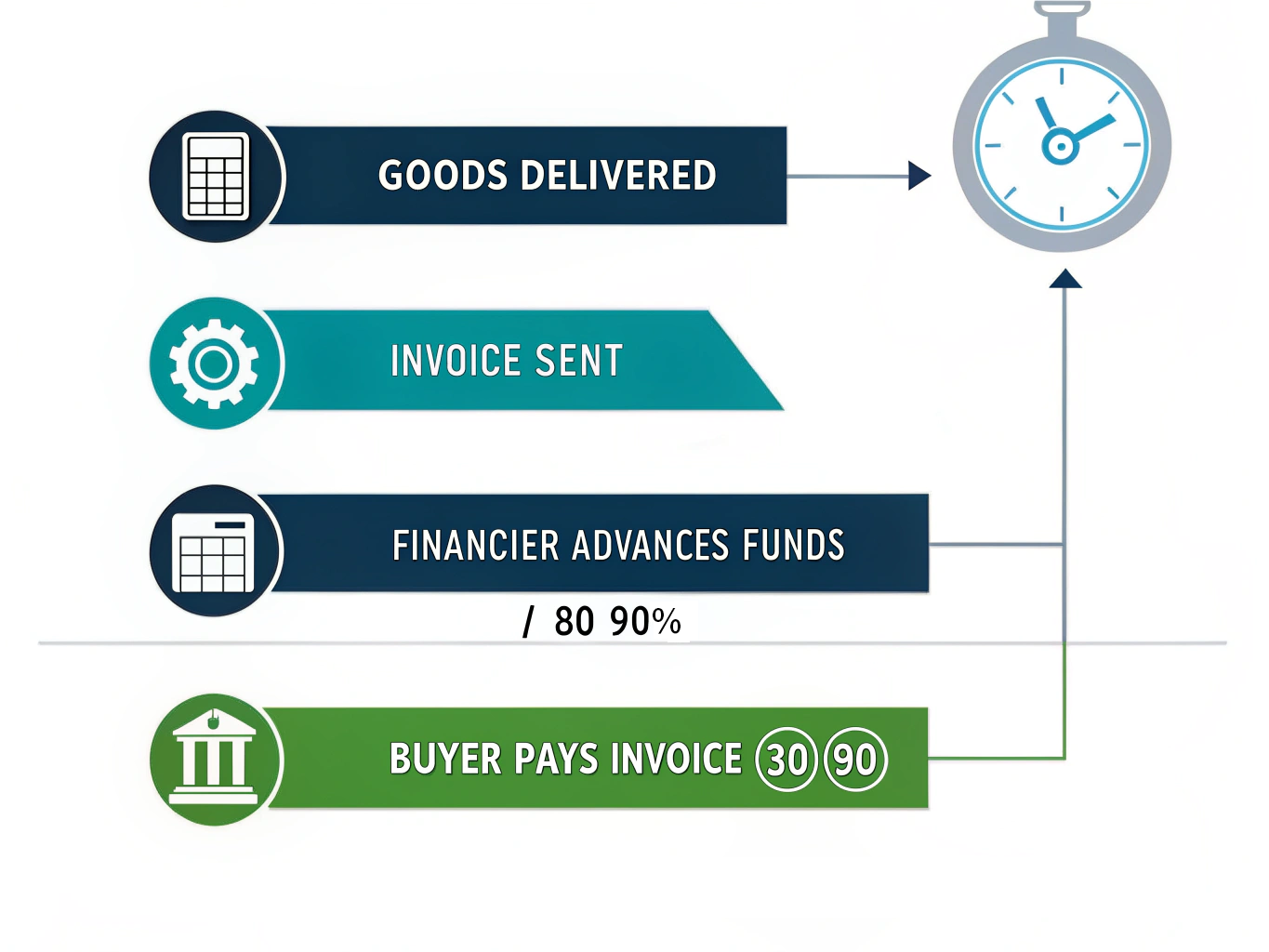

Once I deliver goods and send the invoice, I often wait 30, 60, or even 90 days to get paid. Invoice financing helps me close that gap quickly.

Invoice financing is a post‑shipment solution. Once you’ve sold and invoiced the goods, a financier advances most of the invoice value, minus a small fee. This gives you quick liquidity and supports your next purchase cycle.

Invoice Financing Structures

| Type | Description | Suitable When |

|---|---|---|

| Invoice Factoring | Financier collects directly from your customer | You don’t mind outsourcing collections |

| Invoice Discounting | You collect payment; financier gives upfront cash | You prefer to handle client relationships |

For steel parts—which often go into manufacturing lines—delays in buyer payment can create serious cash flow issues. Invoice financing allows you to unlock capital without waiting for payment.

Footnotes

World Bank overview of trade finance tools. ↩

Detailed guide to Letters of Credit on Investopedia. ↩

Basics of bank guarantees from a finance provider. ↩

Trade finance guide from gov’t trade support site. ↩

IFC insights into trade finance mechanisms. ↩

Export.gov explanation of payment guarantees. ↩

Investopedia’s definition of purchase order financing. ↩