I’ve had more than one project where I underestimated the clock-time and the delays cascaded across the whole supply chain—and yes, it always felt avoidable.

In short: yes, you can predict typical lead-times when importing custom metal parts from Vietnam—but you must build in the right expectations, buffers and contract terms.

Now let’s walk through how long tooling and setup 1 take, how much time prototypes add, full production runs, how order size & complexity affect everything — and why understanding supplier scale and payment/inspection terms matters.

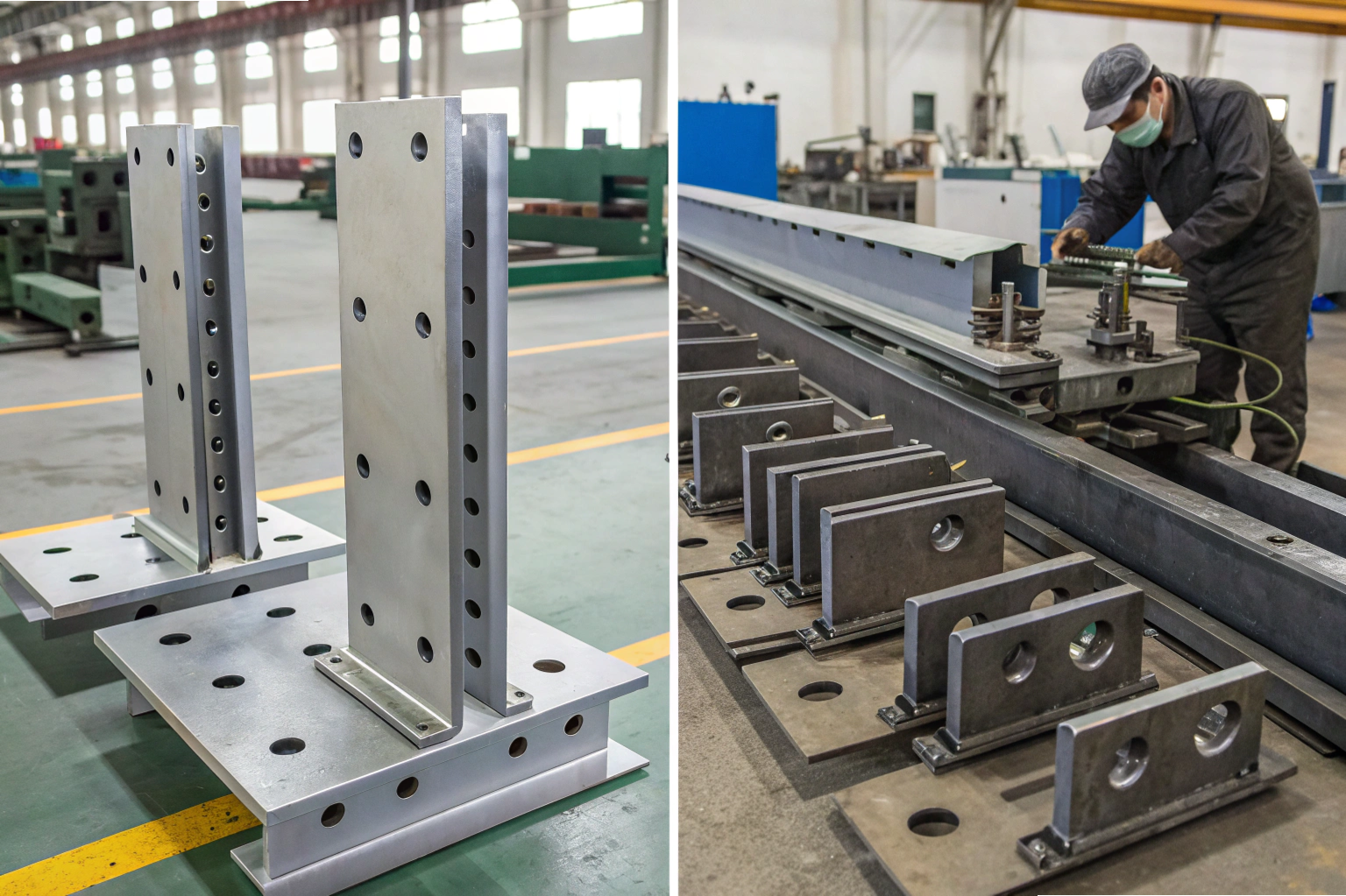

How long for tooling & setup?

I remember a case where we thought “tooling will be quick”—but by the time moulds, jigs and fixtures were made, verified, and approved, a week had slipped away.

Tooling and setup for new custom metal parts in Vietnam typically require anywhere from 1 to 3 weeks (or more) before full production can start.

Some sourcing guides note that Vietnam’s supplier base is expanding rapidly and many medium-sized factories now accept smaller runs—but tooling still remains a fixed hurdle: supplier base expanding and accepting smaller runs 2.

You should allow time for design, fabrication, testing, and approval. Even simple CNC parts require fixture preparation and machine programming. If your part uses a special alloy or imported raw material, sourcing might delay even further.

A realistic timeline might look like this:

| Phase | Timeline (days) | Description |

|---|---|---|

| Tooling Design & Approval | 1–7 | Confirm dimensions, 2D/3D drawings |

| Tooling Fabrication | 8–14 | CNC, EDM, or casting process |

| Sample Run & Debug | 15–21 | First Article Inspection (FAI), fixes if needed |

If complexity increases, this setup stage might stretch up to 4-6 weeks. According to one benchmarking article on Vietnam lead times 3, full production lead time for “new tooling / complex specs” can take 4-8 weeks.

How many weeks for prototype runs?

We’ve had cases where sample delays were the biggest hidden killer of our lead time.

A realistic timeframe for prototype or sample run is 1 to 2 weeks (sometimes 2-4 weeks) before full production can go ahead.

This assumes tooling is ready; any revision, inspection or failed sample adds time significantly. A good practice gleaned from Vietnam sourcing guides 4 is to require pre-production sample inspection via video or a third-party to reduce that risk.

Once tooling is ready, the supplier will run a batch (e.g., 10–50 pcs). You can inspect it online or send to a third-party. If the part fails, or you request improvements, each revision adds several days or more.

A smart approach is to require sample inspection upfront. You might include this in your PO: “Supplier must submit PPS and receive written approval before mass production.”

If everything goes smoothly:

- Sample run: 3–5 days

- Transit (optional): 3–5 days

- Inspection: 1–3 days

- Feedback loop or revision: 3–7 days

Total: around 2 weeks (optimistically)

What’s full production cycle lead time?

The fastest runs I’ve seen were for simple repeat jobs: 2 weeks and done. But most custom projects are slower.

Repeat orders take 10–20 business days. New or complex orders take 3–6 weeks or longer for full production.

A Vietnam manufacturing report 5 states: “Typical lead times for welded assemblies in Vietnam are 4-8 weeks depending on order complexity.”

You can break it down into two broad categories:

| Type of Order | Manufacturing Lead Time | Total (incl. shipping) |

|---|---|---|

| Repeat (same part, existing tooling) | 2–4 weeks | ~35–50 days |

| New tooling / complex specs | 4–8 weeks | ~50–70+ days |

Shipping time adds further delay:

- Sea freight: 2–5 weeks depending on route

- Export & customs: 3–7 days

- During peak season or near holidays (e.g., Tết Nguyên Đán 6) expect further delays

Always factor:

- Surface finish requirements

- Multi-step operations (welding, coating, etc.)

- QC inspection rounds

These steps add time. You should also build in time for rework if tolerances are tight. A lead-time management guide 7 emphasises early planning, clear specs, and milestone tracking.

How do order size & complexity affect lead time?

A high-volume order with tight tolerances and 3D contours? That’s not going to be ready in two weeks.

Larger orders and more complex parts require longer production time — not just due to machine hours, but because of process dependencies and quality risk.

Vietnam’s metal-manufacturing landscape 8 includes many medium-sized factories that are scaling up (rather than massive high-volume only), meaning you often have more flexibility—but also less buffer for delays than very large plants.

Here’s what typically stretches lead time:

| Factor | Impact on Lead Time |

|---|---|

| Order Quantity | Larger batches take longer to machine, QC, and pack |

| Part Complexity | Multi-process parts (e.g., CNC + welding + anodising) add 1-2 weeks |

| Raw Material Type | Imported or exotic alloys delay start by 1-3 weeks |

| Factory Load | Peak season = queue time before your part enters machine |

| Holiday Periods | Tết holiday can delay 2–3 weeks |

| Approval Loops | Design revisions, sample feedback add days to weeks |

| Third-Party QC | Coordination and scheduling inspection may add 1-5 days |

To reduce delays:

- Lock down drawings and tolerances early

- Approve tooling before order confirmation

- Get pre-sample video or third-party report

- Use production milestone tracking 9 and demand visibility

Conclusion

Typical production lead time for custom metal parts from Vietnam is 4-8 weeks for new orders, and 2-4 weeks for repeats — plus shipping time.

Plan early, build in buffers, use sample checkpoints, and review Vietnam logistics and freight overview 10 to set accurate expectations.

Footnotes

1. Vietnam tooling production guide explaining setup and preparation processes. ↩︎

2. Report noting Vietnam’s medium-sized suppliers offering flexible production. ↩︎

3. Benchmark article on new tooling and lead-time cycles. ↩︎

4. Sourcing guide recommending pre-production inspection and sample checks. ↩︎

5. Analysis on Vietnam’s average metal manufacturing lead times. ↩︎

6. Overview of Vietnam’s Tết holiday schedule and supply chain impact. ↩︎

7. Logistics insight on optimizing manufacturing lead time. ↩︎

8. Guide to Vietnam’s metal fabrication landscape and capacity. ↩︎

9. Best practice for milestone tracking in Vietnam production. ↩︎

10. Overview of Vietnam logistics infrastructure and freight times. ↩︎